What is an LLC?

Definition, How it Works, Pros, Cons, & More

One of the most common challenges that future business owners face is choosing the correct form of business entity to establish. Even when you have a great business idea and a promising market research report, this choice can be a major roadblock.

A business entity is commonly known as a business structure. It affects many things, including the paperwork that you need to prepare and file, your ability to withdraw cash, any personal liability, and how much you pay in taxes.

Among several options to choose from is an LLC. Considering how important it is to choose the right business structure, we wanted to help you learn all there is to know about an LLC.

Here are several key things that you need to know before deciding whether an LLC is the right option for your future company.

Limited liability company definition

LLC is an acronym for “Limited Liability Company”. Here is the definition of an LLC:

“LLC is a US-specific hybrid business structure that can have one or more owners, called members, that combines the features of partnership and corporation.”

As you can see, the definition of LLC doesn’t tell you much unless you already understand partnerships and the business structure of corporations, and exactly which of their features an LLC combines.

Let’s examine some details.

From the corporation business entity side, LLC takes limited liability for owners if the business fails due to debts and claims. And, from the partnership business entity side, it takes taxation practices. An LLC business’s profits are viewed as the owners’ personal income and are taxed as such (more on LLC taxes below).

How it works

The best way to understand a business structure is to see how it works. LLC operates on an operating agreement.

The operating agreement includes various details about the company:

- The list of members (owners of the LLC);

- The percentage of profits and losses for each member; and

- Each member’s voting rights.

An LLC can operate with two structures – ownership and management structures.

- The ownership structure – implies that there are one (single-member LLC) or more members of the LLC (multi-member LLC).

- The management structure – implies that the LLC members have appointed managers to manage day-to-day operations. Such an LLC is called manager-managed LLC. If members are managers themselves, it is called a member-managed LLC structure.

The most important feature of an LLC to understand is limited liability. LLC provides additional protection to members from personal liability. If an LLC company has accumulated a number of debts and there are claims against the company, members cannot be pursued by creditors.

Instead, the creditors can only legally go after the company itself and seize its assets. In this turn of events, the members only lose the resources that they’ve invested into the company.

Why you need one

Whether you are starting an online business or a traditional business, you are probably wondering why you should structure it as an LLC organization.

It’s important to note that you are not required by any law to apply and register your business as an LLC (with one exemption).

However, you should do this if you are concerned with any of the following:

- Personal liability – if your sole proprietorship business fails and creditors come after you, you will face liability. However, if you are an LLC owner, the LLC is liable, and you can keep all your personal assets.

- Not enough trust in your business partners – remember the operating agreement we mentioned earlier? Well, thanks to the operating agreement, you and your business partners will know exactly how to divide profits and losses but also responsibilities.

- Funding challenges – creditors prefer loaning money to LLCs over general partnerships and proprietorships.

- If you are a professional who requires a state regulatory board license to trade – in most states, medical providers, legal advisers, and accountants are required to form an LLC structure (PLLC).

8 Types of LLCs You Should Know About

LLC business structure is a broad category that encompasses different types of LLCs. Every one of these LLC types is unique, and knowing the differences can help you to make the right choice for your future business.

Single-member LLC

A single-member LLC structure is best suited for solo entrepreneurs. It comes with fewer requirements than other LLC types regarding paperwork and initial costs.

Multi-member LLC

Multi-member LLC is suitable for people who want to start a business with partners. All LLC members must sign an operating agreement that states their responsibilities and profit/debt share.

Domestic and Foreign LLC

Domestic LLC is perfect for future business owners who live in a state with affordable tax rates, low registration fees, and business-friendly laws. If you want to register an LLC in another state with more favorable fees, laws, and tax rates, it would be considered a foreign LLC.

Series LLC

Series LLC is a company that has a parent LCC and several smaller LLCs, often referred to as cells. Every cell in a series LLC has its own members and can have a completely different purpose and goals than other cells. It’s a perfect choice for entrepreneurs with different viable business ideas.

L3C Company

L3C or low-profit LLC is often used for not-for-profit institutions. L3C companies often find funding more easily because they attract private and philanthropic investments.

Anonymous LLC

As the name suggests, the anonymous LLC type enables you to start a business without disclosing members’ private information.

Restricted LLC

Restricted LLC enables its members to transfer assets to family members without paying high taxes. You can currently register a Restricted LLC in Nevada.

PLLC

PLLC legal structure is a law requirement in many states. PLLC is for professionals who need to have state regulatory board licenses to trade. It includes various professions such as medical providers and legal advisers.

Limited liability company taxes

It’s essential to understand the unique position that LLC companies are in when paying business and income taxes. The Internal Revenue Service (or IRS) is in charge of collecting taxes and administering the Internal Revenue Code in the US. The IRS has labelled the LLC business structure as a “pass-through entity”.

This places LLC into the same position as a Partnership, and Sole Partnership business structures are defined in terms of paying company taxes. An LLC company is just seen as a vessel that the business income goes through. This income goes to the LLC members. Every LLC member is responsible for reporting their own share of profits and losses.

Since profits and losses that go through an LLC company are considered personal income, LLC members don’t have to worry about corporate taxes. This means that the law sees LLC members as self-employed, and they have to pay self-employment tax.

LLCs can file a form with the IRS to request to be taxed as C or S corporations.

Pros and cons of a limited liability company

Before choosing the right business structure for your new business, you need to grasp all of the pros and cons that a specific structure offers.

Here are all of the noteworthy pros and cons of LLC:

Pros

- Protect your assets;

- Save on taxes thanks to the Tax Cuts and Jobs Act;

- Easy to create and operate;

- Flexible management; and

- Ability to choose how to be taxed.

Cons

- High costs of forming and operating an LLC; and

- Funding can be challenging since investors prefer corporations over LLCs.

The costs of forming an LLC

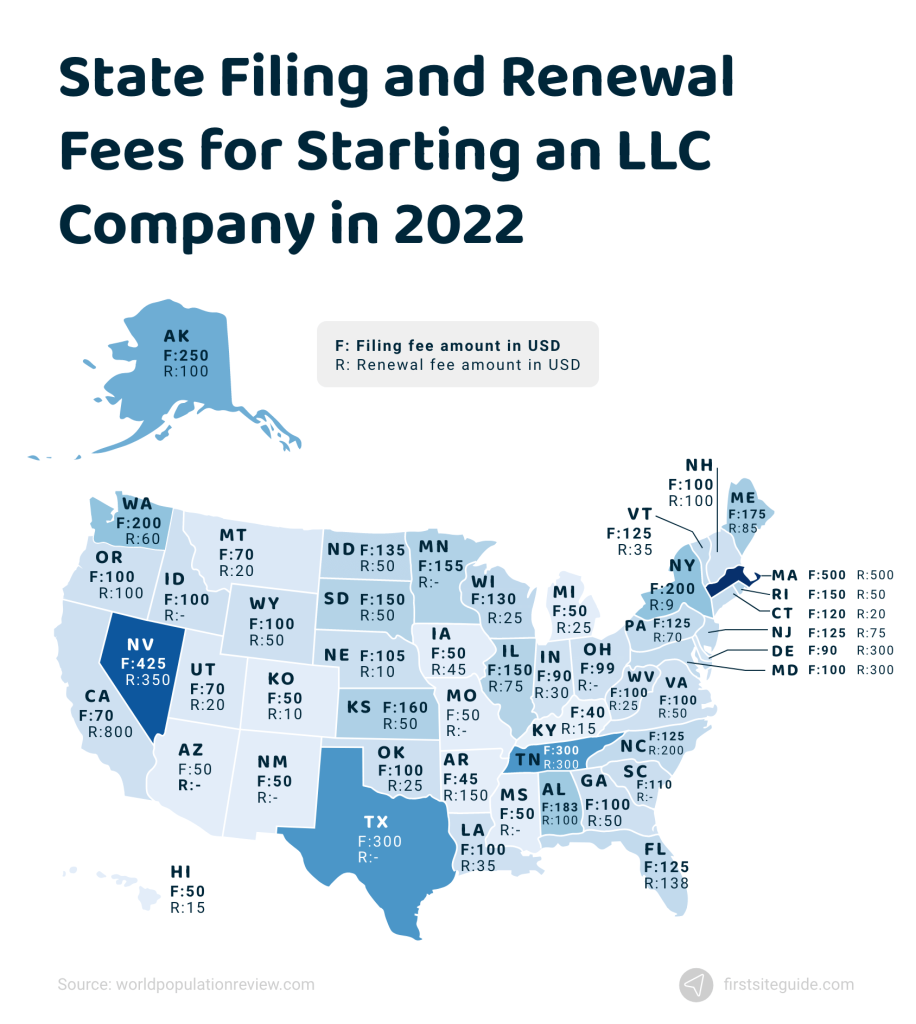

It’s hard to give an exact number related to the exact costs of forming an LLC. If you are wondering how much it costs to form an LLC, it’s important to understand that filing costs vary from state to state (including various fees).

Generally speaking, LLC filing costs are different from state to state and can range anywhere between $40 in Kentucky, and $500 in Massachusetts. You will also have to obtain a business license which can cost you anywhere from $10 up to $200 plus pay the renewal fees every year.

How long does it usually take to form an LLC?

Generally speaking, after you file your articles of organization and pay all of the necessary fees, it can take 14 days on average to form an LLC. Sometimes the process can take longer than that, but usually no longer than 21 days.

How to start an LLC

Since you are considering starting an LLC, you should become familiar with the procedures involved. This can help to assess the complexity of the process and decide whether you will need professional help to do this.

Choose a name

First, decide on a name for your LLC. Coming up with a memorable name can be challenging, and you might find a business name generator helpful. You will need to choose a unique name because state laws don’t allow duplicate business names.

Pick a registered agent

You are also required to have a registered agent. When considering who should be your registered agent, you should ensure that the potential agent is available during business hours at an address in the state where the LLC will be registered.

Set up an operating agreement

Setting up an operating agreement is the next step. It should outline the LLC members’ responsibilities, profit/loss share, and other relevant information about your LLC operations.

File your articles of organization

Next, you will have to complete, sign, and file the articles of organization that are required by the state where you are registering the LLC.

Pay all of the necessary fees

Finally, you will have to pay all of the fees required by the relevant institution in the state.

Conclusion

As you can see, starting an LLC is not as complicated as you might’ve previously imagined. Unlike other business entities, the LLC structure offers unique perks and unites the best elements from partnership and corporation business models.

Choosing LLC over other business entities can help you to protect your assets, save on taxes, and benefit from flexible management. These advantages can hopefully offset the higher filing fees and investment challenges that an LLC can cause.